Building a Strong Foundation

Improve your business credit rating – Establishing a solid foundation is crucial for improving your business credit rating. Paying bills on time is the cornerstone of this foundation, as it demonstrates your creditworthiness and reliability to lenders.

To ensure timely payments, consider implementing a system that automates payments or sets reminders. Additionally, managing cash flow effectively is essential to avoid late payments. This can involve creating a budget, forecasting expenses, and exploring financing options when necessary.

Establishing a Payment System

- Set up automatic payments through your bank or online bill pay services.

- Use calendar reminders or task management apps to track payment due dates.

- Delegate payment responsibilities to a trusted employee or use a third-party service.

Managing Cash Flow

- Create a detailed budget that Artikels your income and expenses.

- Forecast expenses and anticipate cash flow needs to avoid shortfalls.

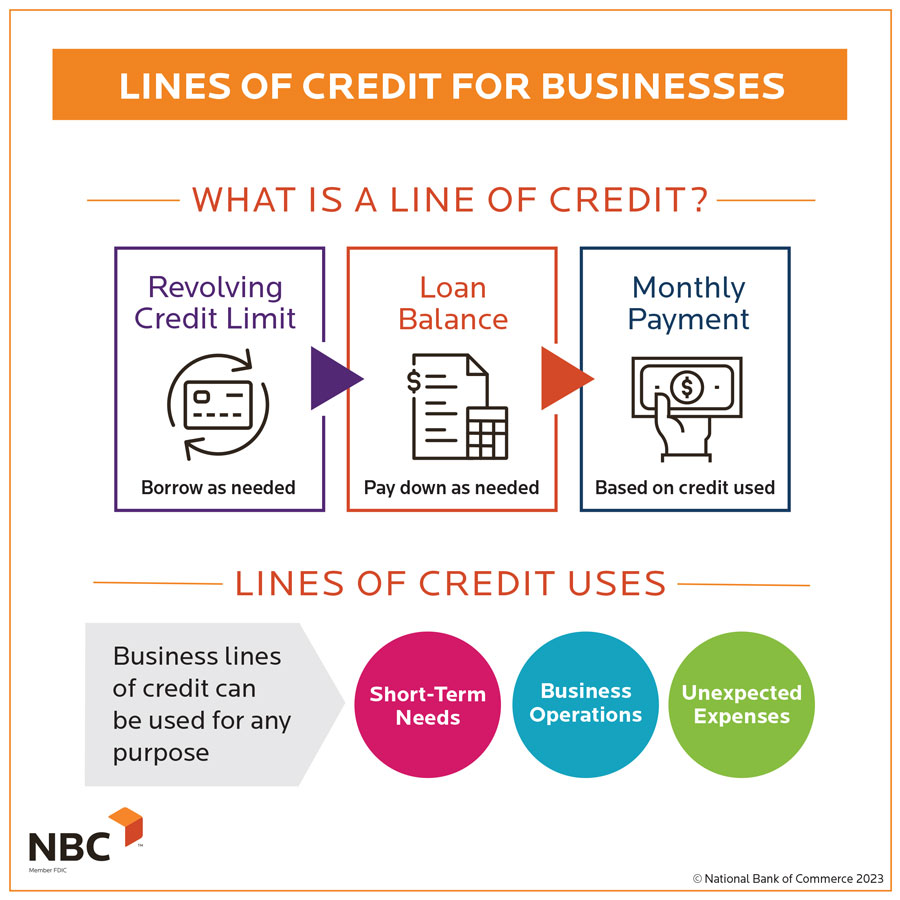

- Explore financing options such as business loans or lines of credit to supplement cash flow when necessary.

Monitoring and Managing Credit

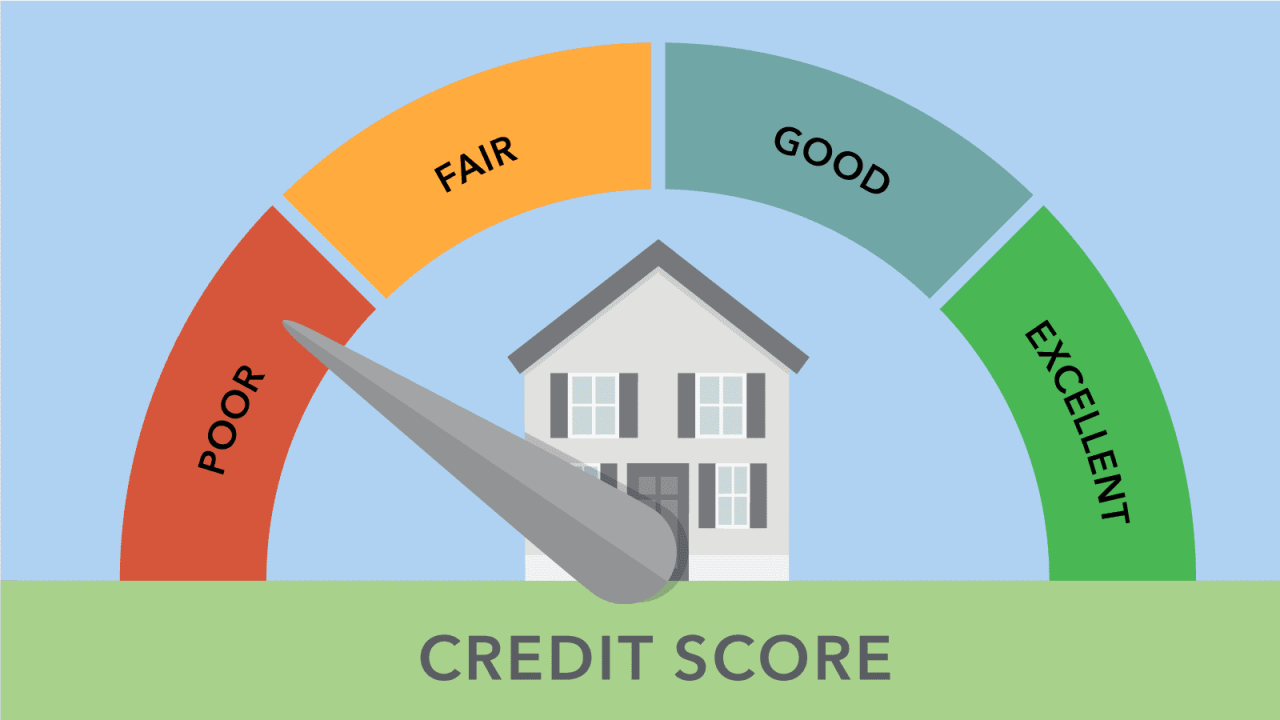

Monitoring and managing your business credit is essential for maintaining a healthy financial profile. By staying on top of your credit reports, you can identify and address any issues that could negatively impact your business.

Here are some tips for monitoring and managing your business credit:

Obtaining Free Credit Reports

You can obtain free credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You can request your free credit reports online, by phone, or by mail. It’s a good idea to request your free credit reports annually to review them for accuracy.

Disputing Errors

If you find any errors on your credit reports, you can dispute them with the credit bureaus. You should dispute any errors in writing and include supporting documentation. The credit bureaus are required to investigate your dispute and correct any errors within 30 days.

Reducing Debt and Utilization: Improve Your Business Credit Rating

Maintaining a strong credit rating requires responsible debt management and low credit utilization. High debt levels can significantly impact credit scores, while keeping credit utilization low demonstrates financial discipline.

Reducing debt can be achieved through various strategies, including debt consolidation, debt settlement, and managing credit utilization effectively.

Debt Consolidation, Improve your business credit rating

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, simplifying debt management and potentially reducing monthly payments. This can help free up cash flow for other financial obligations or savings.

Debt Settlement

Debt settlement is a less favorable option, involving negotiating with creditors to pay less than the full amount owed. While it can provide temporary relief, it can negatively impact credit scores and may result in tax consequences.

Managing Credit Utilization

Credit utilization, the ratio of your outstanding balance to your total credit limit, should be kept low. A high credit utilization ratio can indicate financial strain and negatively impact your credit score.

To manage credit utilization effectively, consider using multiple credit cards with high limits and paying down balances regularly. Avoid maxing out credit cards and aim to keep your credit utilization below 30%.